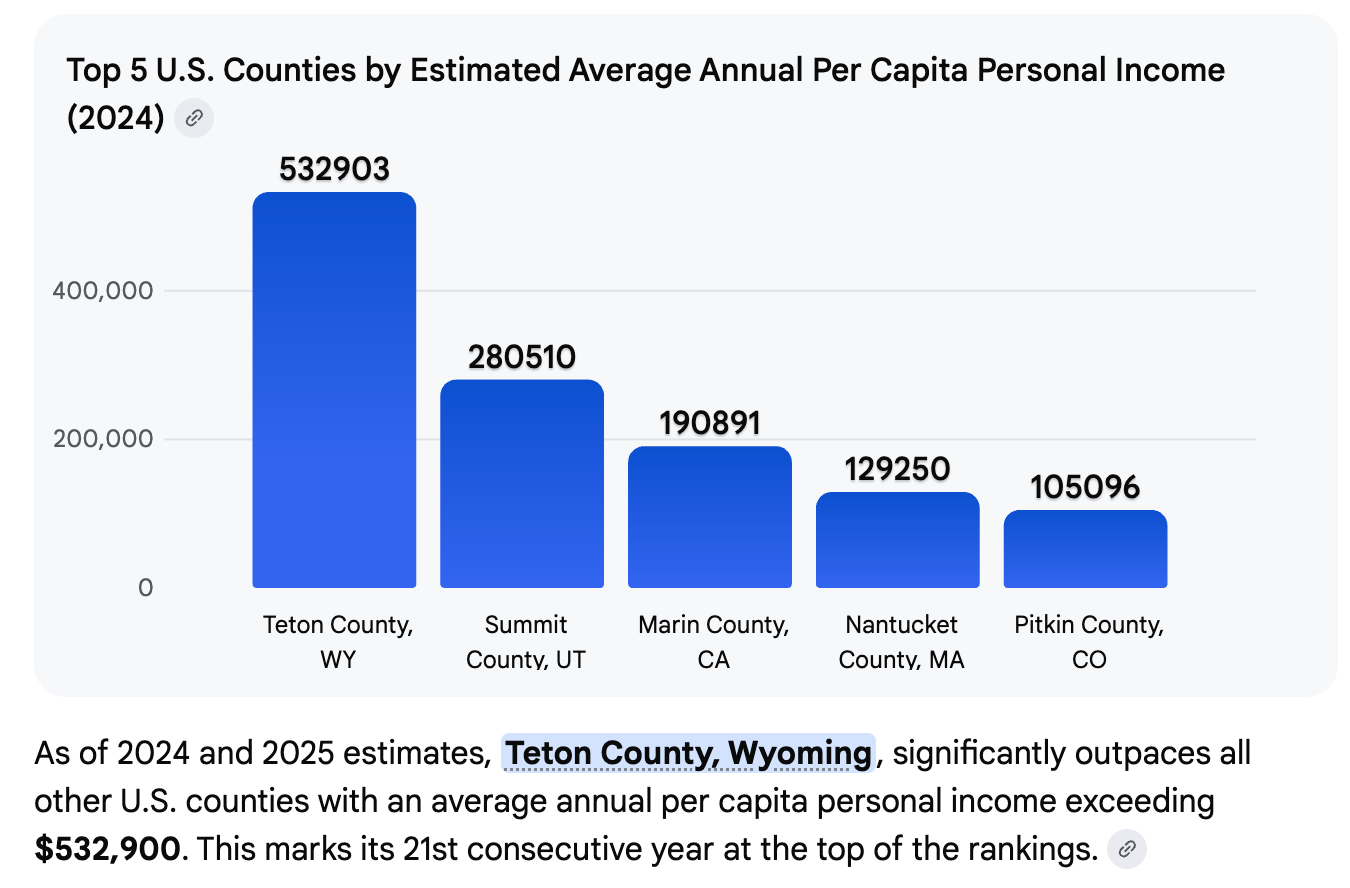

Teton County, Wyoming, is back where it apparently keeps its permanent parking spot: #1 in the U.S. for estimated per capita personal income, clocking in at $532,903 in 2024/25 estimates, according to the Bureau of Economic Analysis (BEA).

Yes, the number is wild. No, it doesn’t mean the “average local worker” is walking around with half a million in annual income. But it does mean one thing that matters to everyone in the state:

Teton County’s economy generates tax revenue that impacts Wyoming well beyond county lines.

The Top 5 USA Counties by Estimated Per Capita Personal Income

- ① Teton County, WY — $532,903

- ② Summit County, UT — $280,510

- ③ Marin County, CA — $190,891

- ④ Nantucket County, MA — $129,250

- ⑤ Pitkin County, CO — $105,096

Quite the difference between Teton County, WY, and Summit County, UT. Just ask yourself, does Utah have the same favorable tax structure as Wyoming? Of course not.

Why Teton’s “Average Income” Is So High

One reason the number is so extreme: Teton’s income mix is not like most counties.

Key Drivers: Investment income, tax policies, and a high concentration of wealthy residents relocating to the area. Investment-heavy income can push averages up fast, even when local wages are not nearly as high as one would expect in the county.

Teton County’s Outsized Role in Wyoming Tax Revenue

Teton County is small by population, but it punches well above its weight in the revenue streams that fund Wyoming’s state and local services. Here are three of the clearest examples.

1.) Statewide sales tax: Teton helps fill the pot, but the state keeps most of it

Wyoming’s 4% state sales and use tax is allocated so that 69% goes to the State General Fund, while the remaining 31% is distributed to counties and municipalities under state formulas.

The Wyoming Legislature’s 2025 Budget Fiscal Data Book shows Teton County received about $15.94 million in FY2024 from the county distribution portion of that statewide 4% tax.

That is a meaningful number on its own, and it also underscores a bigger point: because the state keeps the majority share through the General Fund split, the statewide sales tax captures a much larger pool of economic activity than what shows up in any single county’s distribution line.

2.) Lodging taxes: the cleanest “Teton → statewide” pipeline

If you want the clearest example of how Jackson Hole tourism directly supports statewide funding, it is lodging taxes.

A Jackson Hole tourism-industry analysis reports that Wyoming’s 5% statewide lodging tax generated about $64.1 million in FY2024, and that Teton County was the source of about $27 million of that total.

Wyoming’s 5% lodging tax is typically described as:

- 3% managed by the Wyoming Office of Tourism for statewide marketing

- 2% retained locally in Teton County

Locally, 60% of the retained funds are managed by the Jackson Hole Travel & Tourism Board, and 40% are managed by the Town of Jackson and Teton County, often tied to tourism impacts, infrastructure, and services.

In plain terms, when Jackson Hole lodging demand rises, statewide tourism funding rises with it, because the statewide 3% share scales directly with lodging-tax collections.

3.) Property value concentration: one county, a huge share of the base

Teton County’s property value concentration is also unusually high.

A Wyoming-focused report cited in local coverage put Teton County’s assessed value for residential land, improvements, and personal property at about $3.7 billion in 2024, versus about $10.4 billion statewide for that category. That is roughly 36% of the statewide total in one county.

This helps explain why property tax debates in Wyoming often circle back to Teton County. When one county holds such a large share of the assessed base in key categories, statewide policy changes tend to show up there fast and loudly.

The Ranking Is Flashy, The Revenue Impact Is Real

Teton County’s #1 ranking will always create reactions. But beyond the headlines, the practical takeaway is straightforward:

- Teton’s spending and tourism boost statewide tax collections (especially lodging tax).

- Wyoming’s sales tax system routes major revenue to the State General Fund, meaning strong taxable activity anywhere matters statewide.

- Teton’s property value footprint is disproportionately large, which ripples into broader tax and policy conversations.

So yes, Teton County is America’s income outlier. But it’s also one of Wyoming’s most consequential economic engines.

AntlersArch founder and the voice behind Teton Tattle.